2019 Ricardo Water Markets Report

Background

Australian water management has undergone a significant period of reform over the past three decades. The establishment of water markets has been a key component of this reform story.

Water markets are now an established part of agricultural, urban and environmental water policy, management and investment in Australia.

The Ricardo Water Markets Report provides an overview of current water market activity in the southern Murray–Darling Basin, compares market outcomes with recent years and comments on the future outlook.

>> Click here to download the PDF version

>> Explore other Ricardo Water Markets Reports here

About Ricardo

Ricardo works with businesses, governments and industry groups to enable improved decision making that reflects the value of scarce water resources. Our understanding of the value of water underpins our economics, policy and commercial advisory services in water markets, resources, infrastructure and risk.

Our specialist water markets services include:

- design and analysis of water market policy

- transaction advisory and investment due diligence

- portfolio strategy, optimisation and performance

- water asset valuation services

- using custom-designed water management frameworks and market modelling tools

Ricardo’s water markets team works with Australian and international clients who require high-quality information, insights and analysis to make better decisions and achieve improved outcomes. With an expert team of water economists, strategists, and policy and performance advisers, Ricardo provides the best available water sector advice.

If you would like to find out more about this report or have any feedback, please get in touch.

Chris Olszak, Director

Executive Summary

Facts at a glance – 2018-19

- Estimated value of commercial allocation trade: $566 million (three-fold increase on 2017-18 value)

- Annual average southern MDB allocation price: $375 to $460 per ML

- Estimated value of total southern MDB entitlement on issue: $22.7 billion

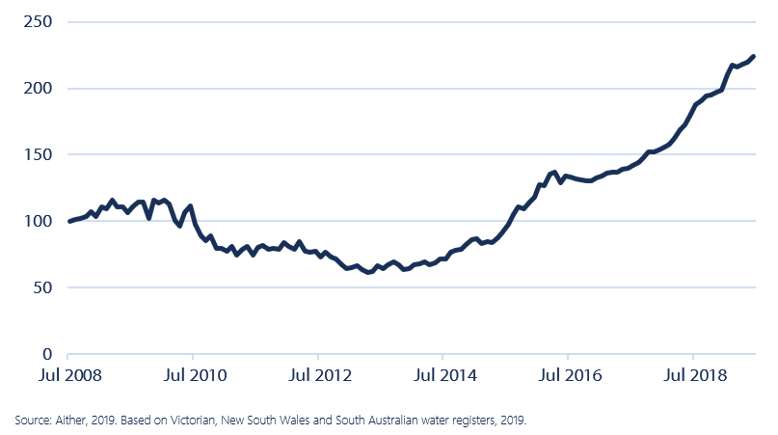

- Ricardo Entitlement Index (AEI) 30 June 2019: 223.77 points (up 24 per cent over 12 months)

- Value of total entitlement transfers: $699 million

- Total volume of entitlement transfers (outside of irrigation corporations): 237 GL (up 48 per cent on 2017-18)

- Entitlement market turnover: 4 per cent

- Average annual entitlement returns (sale of allocations): ~5 per cent

Summary of 2018-19

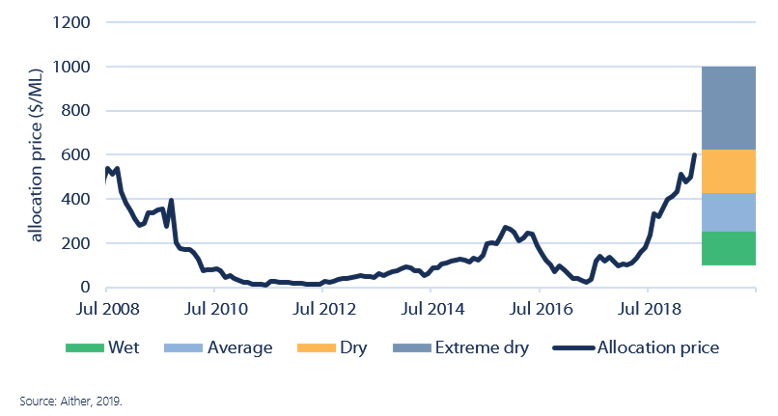

2018-19 will be remembered as a year when widespread dry conditions collided with strong and growing water demand to significantly increase water prices.

Allocation prices in the southern Murray–Darling Basin (MDB) are now being sustained at levels that were only observed briefly in the Millennium Drought. During the 2018-19 water year, average monthly allocation prices increased from approximately $230 per ML (July 2018) to above $550 per ML (June 2019). Likewise, entitlement prices increased for the sixth consecutive year.

Multiple demand side factors drove prices upwards. For example, dry conditions prompted winter croppers to enter the market early in the year to finish off their crops. Murrumbidgee irrigators committed to large areas of cotton and some were caught out by the lack of allocations to their entitlements, resulting in them also needing to enter the allocation market to finish off their crops. Ongoing investment in new almond developments (and other permanent horticulture) in the lower Murray also played a significant role in driving demand. Conversely, rice growers were priced out of the market almost entirely and dairy farmers endured a tough year with unfavourable milk prices and high water and fodder costs driving production down, resulting in some farm business exits.

Allocation market

- Climatic conditions (below average rainfall) and water availability (lower allocation volumes than 2017-18) were major drivers of allocation prices.

- Prices increased steadily throughout the year, exceeding what would previously have been expected given the volumes of consumptive water available. This suggests that significant structural change in demand is taking place.

- Water prices in the Murrumbidgee peaked at approximately $700 per ML in January 2019. This was driven by unexpectedly poor summer growing conditions and inflexible water demand from cotton growers that had already committed to their crops.

Entitlement market

- The Ricardo Entitlement Index (which tracks the relative performance of a group of major water entitlement types across the southern MDB) reached a new record high of 224 in June 2019, up 24 per cent from 181 in June 2018.

- Strong commodity prices for almonds, citrus and grapes are driving sustained investment in these industries. Consequently, demand for high reliability water entitlements is increasing.

- Towards the end of the season, high allocation prices and concerns about water availability and price drove some horticulturalists to buy entitlements as a way of securing long term supply. Some irrigators also appeared to be turning to groundwater, with notable price increases in some systems.

Facts at a glance – Outlook

- Comparison of 2019-20 and 2018-19 opening season allocations to consumptive users (excluding carryover): 1,300 GL less water allocated than at opening of 2018-19

- Estimated 2019-20 total end-of-season volume of water available to southern MDB consumptive users under dry scenario (including carryover): 2,200 to 3,000 GL

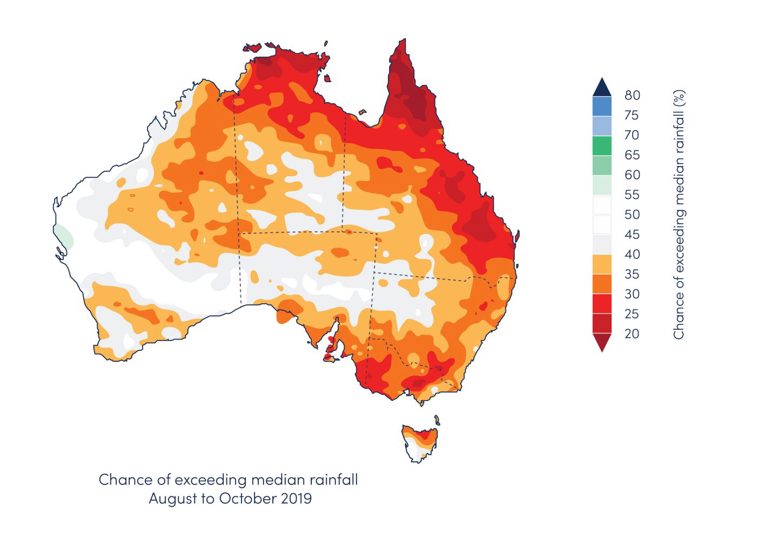

- Current three-month rainfall and inflow outlook for southern MDB: Drier than average

- Current southern MDB allocation prices: $550 to $630 per ML – highest prices since the Millennium Drought

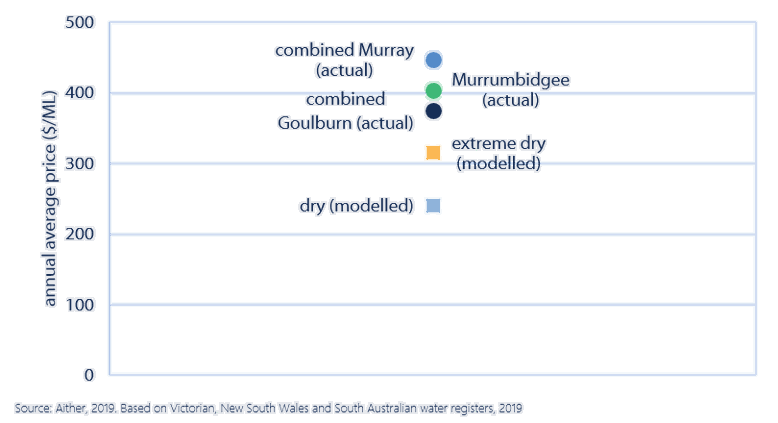

- Ricardo’s modelled estimate of 2019-20 average annual southern MDB allocation price (dry and extreme dry scenarios): $425 to $590 per ML

Outlook for 2019-20 and beyond

Allocation market

- Ricardo expects allocation prices to remain high.

- Based on climate outlooks, widespread dry conditions and low rainfall are expected to persist through the first half of 2019-20.

- Despite some recent rain, inflows remain low. In combination with favourable commodity prices in many industries, this will sustain high prices for 2019-20.

- Horticulturalists will be thinking about the year ahead and moving to secure water for their permanent plantings.

- A big reduction in the cotton crop is expected, unless high inflows return to the Murrumbidgee before October 2019.

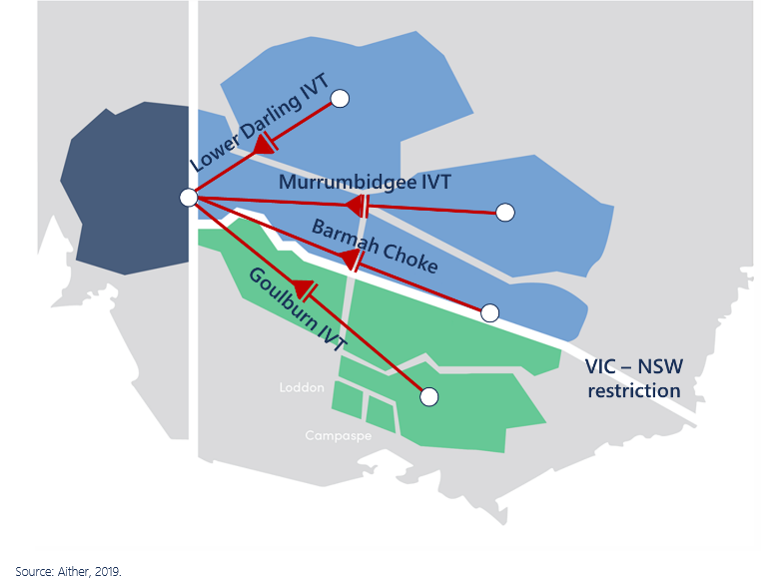

- With trade constraints binding, prices in the Lower Murray are expected to be the highest of all trading zones and, potentially, a large price differential could emerge with upstream trading zones (particularly the Goulburn).

- If the Goulburn IVT remains closed, some dairy farmers and fodder producers that do not hold entitlement to meet all their needs may benefit from lower allocation prices as well as higher milk prices, and potentially increased availability of fodder and hay.

Entitlement market

- Ricardo expects that demand for high reliability entitlement types will remain strong across the southern MDB.

- Entitlement demand will continue to be driven by favourable commodity prices for almonds, table grapes and citrus, combined with the reluctance of most entitlement owners to sell.

- We expect trade restrictions will continue to drive price differentials across entitlement types. High allocation prices in the Lower Murray region will likely continue to place upward pressure on entitlement prices in this zone. This is already being observed in early trading in 2019-20.

- Market participants may be forced to reconsider the value of NSW Murray General Security as well as Goulburn HRWS and Upper Murray entitlements if allocations remain low and trade restrictions continue to bind, resulting in lower returns.

1.0. Introduction

1.1. Introduction

The Ricardo Water Markets Report is now in its sixth year.

The report provides water market participants, advisors, investors and policy professionals with an up-to-date and accessible overview of recent water market drivers and activity in the southern Murray–Darling Basin (MDB) (Figure 1).

The Ricardo Water Markets Report 2018-19 highlights the unfolding story of intensifying dry conditions and reduced water available for consumptive users, combined with structural changes in water demand.

Our review of 2018-19 shows that the combination of these structural demand changes, climate change and cyclical conditions is having a significant influence on both entitlement and allocation market prices. Our outlook for 2019-20 explores how these factors may play out over the course of the year ahead.

Figure 1. Southern Murray-Darling Basin Water Trade Zones

Source: Ricardo, 2019.

2.0. Market Drivers

2.1. Climatic Conditions

2.1.1 Persisting dry conditions

2018-19 was another dry year across the MDB. Rainfall was either below or very much below average for most of the MDB (Figure 2).

A key driver of reduced rainfall in 2018-19 was a positive Indian Ocean Dipole (IOD) which tends to shift rainfall patterns, and results in lower rainfall across south-east Australia.

The northern MDB was particularly dry with parts of the Border Rivers region observing the lowest rainfall on record. Rainfall conditions in the southern MDB tended to be better, although many regions recorded average to very much below average rainfall.

These climate dynamics have intensified the drought conditions across the MDB following a similarly dry 2017-18 (Figure 3).

Figure 2. Rainfall deciles, 1 July 2018 to 30 June 2019

Source: Ricardo, 2019. Based on Bureau of Meteorology, 2019

Figure 3. Rainfall deciles, 1 July 2017 to 30 June 2018

Source: Ricardo, 2019. Based on Bureau of Meteorology, 2019

2.1.2 Below average and inconsistent on-farm rainfall

Below average rainfall across the MDB was reflected in below average on-farm rainfall throughout may irrigation regions in the southern MDB.

Figure 4 shows that during the first three months of 2018-19, many growing regions received below average rainfall. This resulted in strong early season demand for irrigation allocations by winter crop growers.

The dryland drought conditions increased fodder prices which meant that it became cost prohibitive for dairy farmers to purchase fodder instead of irrigating.

There was also limited rainfall over the summer in many key irrigation regions which further increased irrigation demand from permanent horticulturalists and those summer croppers that were able to plant in 2018-19.

Figure 4. Monthly observed and median rainfall across major Southern Murray-Darling Basin regions, 2018-19

Left axis - Monthly rainfall (mm)

Green - Monthly rainfall median

Blue - 2018-19 rainfall

Source: Ricardo, 2019. Based on Bureau of Meteorology, 2019

2.2. Storages and Allocations

2.2.1 Declining storage levels

Persistent dry conditions, combined with high levels of water use, have resulted in a significant reduction in water held in the major southern MDB headwater storages. Storage levels have fallen from 63 per cent in July 2018 to 42 per cent in July 2019.

This decline continues the downward trend since late 2016. Storage levels are now at some of the lowest levels experienced since the Millennium Drought (Figure 5).

Figure 5. Major headwater storages, southern Murray–Darling Basin, 1 July 2000 to 30 June 2019

2.2.2 Lower total allocations than 2017-18

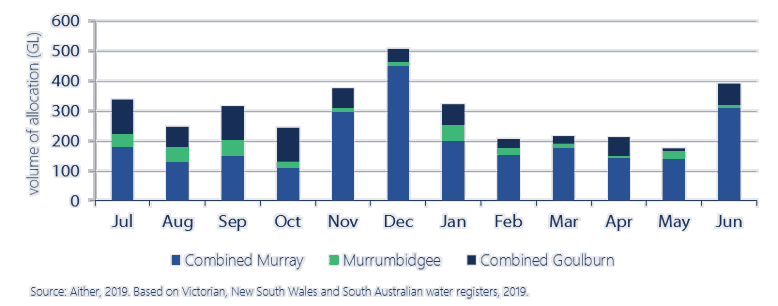

Across the southern MDB, approximately 3,326 GL was allocated to water entitlements, which is the lowest total volume allocated since 2008-09 (Figure 6).

Total allocations in 2018-19 also continued a downward trend in water availability over the last three water years. Allocations were 33 per cent less than in 2017-18, and 51 percent less than in 2016-17 (Figure 6).

Figure 6 also shows the volume of water allocated to entitlements purchased by the Commonwealth Government through buybacks which are no longer available for consumptive use. In 2018-19, this was approximately 17 per cent of total water allocated.

Figure 6. Estimated total volume of water allocated to consumptive use and Commonwealth environmental water in the southern Murray-Darling Basin, 2008-09 to 2018-19

2.2.3 Lower total opening allocations across the MDB

Opening water allocations to many major southern MDB entitlement types were also lower in 2018-19 than in 2017-18 (Figure 7). While in some cases, allocations eventually reached 100 per cent (equal to 2017-18), delayed allocations meant that users were more likely to turn to the allocation market at the beginning of the season to secure water, rather than wait for allocations to their entitlements.

Notably, NSW Murray General Security allocations remained at zero per cent for the whole year leaving many holders of these entitlements disappointed.

Figure 7. Water allocation determinations made to major Southern Murray-Darling Basin entitlement types, 2017-18 and 2018-19

Left axis - Cumulative allocation determination (%)

Green - 2017-18 seasonal determinations

Blue - 2018-19 seasonal determinations

Source: Ricardo, 2019. Based on Bureau of Meteorology, 2019

2.3. Demand for Water

2.3.1 Increasing demand from permanent horticulture

Since 2010-11, irrigated cotton growing has emerged in the southern MDB. As the industry has grown, increased volumes of water have shifted towards cotton, and away from other summer crops, such as rice in the NSW Riverina (ABS, 2018).

A similar story is emerging for permanent horticulture. Recent research by Ricardo (commissioned by the Victorian Government Department of Environment, Land, Water and Planning) has examined the changing balance of water supply and demand in the southern MDB. Using multiple data sources, we established a more accurate and current estimate of the total volume of horticultural water demand in the connected Murray and Goulburn systems. This estimate is based on existing and planned plantings and orchard maturation trajectories.

While the exact figures remain difficult to confirm, our results show that permanent horticultural crop demands in the southern MDB are higher than previous estimates. This demand will continue to grow as existing plantings mature and new developments proceed across the southern MDB.

Our assessment suggests that there is potentially demand for approximately 1,400 GL per annum in the connected Murray and Goulburn, and potential for approximately 160 GL of additional demand if developments in various stages of planning eventuate.

As a result, in extreme dry conditions in the future (similar to 2007-08), the volume of water allocated across the connected Murray and Goulburn systems may be only slightly higher than the water demand attributable to existing plantings, excluding the effects of carryover, trade constraints and market behaviour (Figure 8).

Figure 8. Water availability scenarios and baseline permanent horticulture water demand (at full maturity), southern MDB (excluding Murrumbidgee)

2.4 Implications for the Market

2.4.1 Market prices are deviating from historical trends

Persistent and intensifying dry conditions that reduce water availability and changing patterns of water demand are combining to reshape the historical relationship between water allocations and water prices.

Figure 9 presents the last 11 water years ordered from lowest to highest volume-weighted average price (VWAP). This shows that, in general, as the volume of water allocated to entitlements increases, market prices decrease.

However, this relationship shifted considerably in 2018-19. Average prices in 2018-19 were the highest on record, while water allocations were not at the lowest on record. Despite almost 900 GL of additional water being allocated for consumptive use in 2018-19 compared to 2008-09, average allocation prices were 38 per cent higher. This suggests that significant structural change in demand is taking place.

Figure 9. Water allocated and average annual volume-weighted average prices, 2008-09 to 2018-19

3.0. Water Policy Update

3.1. The Year in Water Policy and Management

2018-19 was a tumultuous year for water policy and management in the MDB.

Following mounting unease with the implementation of some elements of the MDB Plan, significant inter-governmental agreement was reached at the MDB Ministerial Council (MinCo) meeting in December 2018.

However, the fish death events in the Lower Darling and release of the South Australian Royal Commissioner’s report in January 2019 threw Basin water policy and management into the public spotlight during the New South Wales state and the federal election campaigns.

While governments are still working together to refine implementation of the Plan, polarised views persist throughout Basin communities and the Australian public. Amongst other initiatives, these ongoing concerns have prompted the Australian Government to announce two important inquiries: an independent panel to assess the social and economic conditions of irrigated communities across the MDB and the ACCC Inquiry into markets for tradeable water rights.

Figure 10 presents a timeline of key water policy events across the MDB during 2018-19.

Figure 10. Timeline of Murray-Darling Basin water policy events, 2018-19

3.2 Summary of Key Water Policy Events

Barmah Choke Bypass through Mulwala Canal

August, 2018

WaterNSW and Murray Irrigation agreed to allow water through the Mulwala canal, bypassing the Barmah Choke (for 2018-19 only). This was designed to improve peak deliverability downstream to the Lower Murray. It was a one-year agreement and it is unclear if it will be extended.

MINCO Deal to complete MDB Plan

14 December, 2018

The MDB Ministerial Council reached a long-awaited agreement on the socio-economic criteria for the 450 GL of additional water recovery under the Plan, as well as a range of other key matters.

Productivity Commission’s five-year Basin Assessment

25 January, 2019

The Productivity Commission (PC) released its five-yearly assessment of the effectiveness of the Basin Plan implementation. The PC found that Basin states have made significant progress in implementing key elements of the Basin Plan, however further work is required to achieve its full implementation.

South Australian Murray-Darling Basin Royal Commission

31 January, 2018

The South Australian Government released the findings of the state’s MDB Royal Commission. The Commissioner’s scathing recommendations included: reassessing the sustainable diversion limits (SDL) and the volumes required for further water recovery efforts; full disclosure of all previous modelling, assumptions and other parameters used to develop the Plan; improved monitoring, metering and compliance actions; and enhanced rights for Traditional Owners.

Foreign Ownership Register released

1 March, 2019

The Australian Government released the first report of the Register of Foreign Ownership of Water Entitlements. It showed that approximately 10 per cent of Australian water entitlements have some level of foreign ownership. The largest volume of foreign owned water entitlements is in Western Australia (26 per cent), followed by Queensland (18 per cent) and New South Wales (9 per cent). The level of foreign ownership of MDB water entitlements (approximately 9 per cent) is slightly lower than the level of foreign ownership of all Australian water entitlements.

Independent Fish Death Assessment released

10 April, 2019

Large-scale fish deaths in several NSW rivers and storages attracted significant media attention in December 2018 and January 2019. The Federal Government and Federal Opposition established separate independent panels to investigate and propose remedial actions. The final report of the Government-appointed panel — chaired by Ricardo Senior Associate Robert Vertessy — stated that the fish deaths were caused by a combination of low flows, poor water quality and a sudden change in temperature, causing the weir pools to suddenly de-stratify resulting in low oxygen levels. The panel further noted that there were several other contributing factors, including climate conditions, hydrology and water management, such as the operation of the Menindee Lakes system.

Independent panel to investigate socio-economic conditions in irrigated communities announced

8 April 2019

The Australian Government announced the establishment of an independent panel to undertake an assessment of social and economic conditions in irrigated communities across the MDB.

MDBA Releases Investigation on Price Reporting

31 May 2019

The MDBA released the findings of its investigation into reporting of water trading. The key finding was that complete and accurate consolidated reporting is impossible due to an absence of robust arrangements across Basin governments to gather comprehensive price information

Following the start of the 2019-20 water year:

Victoria slows irrigation growth below the Barmah Choke

11 July, 2019

The Victorian Water Minister, Lisa Neville, announced that no new licences for water extraction in the Victorian Lower Murray will be issued, nor extraction limit increases be granted, unless it can be shown that there will be no increased risks to the environment or entitlement holders. The announcement followed heightened concern about the deliverability of water to downstream water holders and environmental impacts. Minister Neville requested that New South Wales and South Australia put in place similar arrangements.

ACCC Inquiry Announced

7 August, 2019

The Australian Government has directed the ACCC to conduct an inquiry into markets for tradeable water rights in the MDB. The Inquiry will span the operations, transparency, regulation, competitiveness and efficiency of markets for tradeable water rights. The ACCC’s interim report is due 31 March 2020, with the final report completed by 30 November 2020.

4.0. Allocation Markets

4.1. Allocation Trade Prices

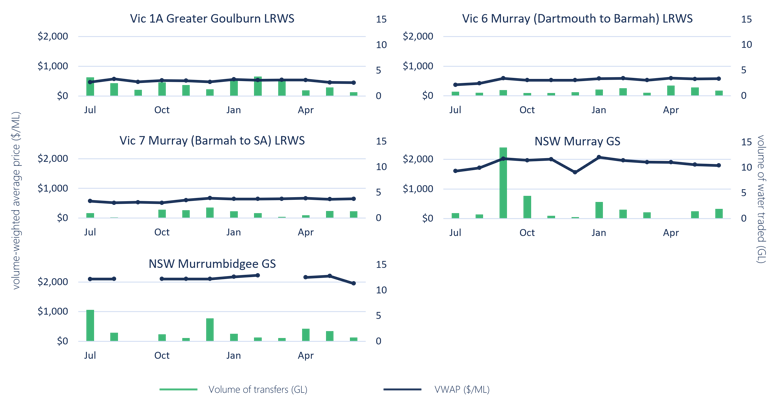

Annual water allocation VWAPs rose rapidly across 2018-19 — in some cases more than tripling 2017-18 prices (Table 1). 2018-19 average prices diverged across the southern MDB zones – from approx. $375 per ML in the Greater Goulburn to approx. $465 per ML in the Victorian Lower Murray – with the price difference being driven by trade constraints.

For example, the lower VWAP in the Greater Goulburn reflects the inter-valley trade limit (IVT) being in effect throughout much of the year, limiting trade to the Murray where higher prices were obtainable.

The estimated total value of commercial (as opposed to ‘non-commercial’ or related party) allocation trade in the southern MDB for 2018-19 was $566 million, tripling the 2017-18 estimate of $189 million.

This estimate uses allocation transfers reported at $0 per ML as a proxy for non-commercial transfers. This approach may understate the total value of commercial trade because known trade disclosure issues result in the reporting of some commercial allocation trades at $0.

Table 1. Annual volume-weighted average allocation prices, major Southern Murray-Darling Basin zones, 2015-16 to 2017-18

|

Trading zone

|

VWAP 2016-17 ($/ML)

|

VWAP 2017-18 ($/ML)

|

VWAP 2018-19 ($/ML)

|

Change in price 2017-18 to 2018-19 (%)

|

|---|---|---|---|---|

|

Vic 1A Greater Goulburn

|

$47

|

$99

|

$374

|

276%

|

|

Vic 6 Murray (Dart to Barmah)

|

$47

|

$115

|

$415

|

261%

|

|

Vic 7 Murray (Barmah to SA)

|

$47

|

$137

|

$463

|

238%

|

|

NSW Murray

|

$47

|

$127

|

$412

|

226%

|

|

NSW Murrumbidgee

|

$27

|

$138

|

$404

|

192%

|

|

SA Murray

|

$58

|

$152

|

$431

|

183%

|

|

Trading Zone

|

Within

|

Into

|

Out of

|

Net Change (ML)

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Vic 1A Greater Goulburn

|

6,084

|

620,701

|

1,419

|

128,134

|

2,403

|

255,663

|

-127,529

|

||||||

|

Vic 6 Murray (Dart to Barmah)

|

753

|

105,829

|

516

|

46,204

|

1,174

|

152,570

|

-106,366

|

||||||

|

Vic 7 Murray (Barmah to SA)

|

5,713

|

541,591

|

3,504

|

459,754

|

1,474

|

813,732

|

-353,978

|

||||||

|

NSW Murray

|

1,346

|

226,709

|

938

|

172,679

|

335

|

80,921

|

91,758

|

||||||

|

NSW Murrumbidgee

|

1,092

|

314,695

|

28

|

10,220

|

256

|

54,985

|

-44,765

|

||||||

|

SA Murray

|

789

|

224,890

|

560

|

663,416

|

417

|

130,302

|

533,114

|

||||||

|

TOTAL

|

15,777

|

2,034,415

|

6,965

|

1,480,407

|

6,059

|

1,488,173

|

|||||||

|

Trading zone

|

Within

|

Into

|

Out of

|

Net change (ML)

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Vic 1A Greater Goulburn

|

4,235

|

275,633

|

1,085

|

52,784

|

1,983

|

96,212

|

-43,428

|

||||||

|

Vic 6 Murray (Dart to Barmah)

|

454

|

16,159

|

388

|

19,178

|

965

|

69,088

|

-49,910

|

||||||

|

Vic 7 Murray (Barmah to SA)

|

4,170

|

330,316

|

2,899

|

191,431

|

1,135

|

117,478

|

73,953

|

||||||

|

NSW Murray

|

842

|

83,135

|

750

|

87,306

|

218

|

31,473

|

55,833

|

||||||

|

NSW Murrumbidgee

|

827

|

155,523

|

13

|

2,572

|

215

|

26,821

|

-24,249

|

||||||

|

SA Murray

|

403

|

56,198

|

445

|

67,594

|

354

|

53,201

|

14,393

|

||||||

|

TOTAL

|

10,931

|

916,964

|

5,580

|

420,864

|

4,870

|

394,273

|

|||||||

- the substantial cotton and corn crops planted in the Murrumbidgee,

- restriction of transfers into the Murrumbidgee, and

- growers’ willingness to pay a premium in order to secure water.

Blue - VWAP (S/ML)

|

Entitlement type

|

No.

|

Volume (ML)

|

Annual VWAP ($/ML)

|

Annual change in price (%)

|

Three-year change in price (%)

|

|||

|---|---|---|---|---|---|---|---|---|

|

Vic 1A Greater Goulburn HRWS

|

845

|

38,647

|

$2,792

|

$3,628

|

30%

|

41%

|

||

|

Vic 1A Greater Goulburn LRWS

|

348

|

27,281

|

$366

|

$517

|

41%

|

75%

|

||

|

Vic 6 Murray (above Choke) HRWS

|

272

|

22,847

|

$2,865

|

$3,830

|

34%

|

47%

|

||

|

Vic 6 Murray (above Choke) LRWS

|

142

|

12,516

|

$375

|

$558

|

49%

|

99%

|

||

|

Vic 7 Murray (below Choke) HRWS

|

961

|

39,416

|

$3,249

|

$4,530

|

39%

|

56%

|

||

|

Vic 7 Murray (below Choke) LRWS

|

191

|

12,259

|

$386

|

$620

|

61%

|

115%

|

||

|

NSW Murray HS

|

63

|

4,082

|

$3,892

|

$5,740

|

47%

|

70%

|

||

|

NSW Murray GS

|

75

|

30,944

|

$1,362

|

$1,964

|

44%

|

62%

|

||

|

NSW Murrumbidgee HS

|

25

|

7,994

|

$3,743

|

$5,762

|

54%

|

62%

|

||

|

NSW Murrumbidgee GS

|

44

|

22,383

|

$1,664

|

$2,139

|

25%

|

46%

|

||

|

SA Murray HS

|

165

|

18,710

|

$3,039

|

$4,578

|

51%

|

62%

|

||

|

TOTAL

|

3,131

|

237,078

|

||||||

Right axis - Volume of water traded (GL)

Right axis - Volume of water traded (GL)

|

Entitlement type

|

Total entitlement on issue (ML)

|

CEWH held entitlement (ML)

|

VWAP 2018-19 ($/ML)

|

Estimated value of consumptive (million)

|

Estimated value of CEWH purchase (million)

|

|---|---|---|---|---|---|

|

Vic 1A Greater Goulburn HRWS

|

982,364

|

317,453

|

$3,628

|

$2,412

|

$1,152

|

|

Vic 1A Greater Goulburn LRWS

|

426,724

|

42,467

|

$517

|

$199

|

$22

|

|

Vic 6 Murray (above Choke) HRWS

|

320,452

|

90,577

|

$3,830

|

$880

|

$347

|

|

Vic 6 Murray (above Choke) LRWS

|

130,680

|

8,853

|

$558

|

$68

|

$5

|

|

Vic 7 Murray (below Choke) HRWS

|

937,650

|

271,730

|

$4,530

|

$3,017

|

$1,231

|

|

Vic 7 Murray (below Choke) LRWS

|

179,474

|

26,560

|

$620

|

$95

|

$16

|

|

NSW Murray HS

|

189,704

|

20,933

|

$5,740

|

$969

|

$120

|

|

NSW Murray GS

|

1,674,096

|

391,193

|

$1,964

|

$2,520

|

$768

|

|

NSW Murrumbidgee HS

|

363,698

|

10,199

|

$5,762

|

$2,017

|

$59

|

|

NSW Murrumbidgee GS

|

1,891,9995

|

283,203

|

$2,139

|

$3,441

|

$606

|

|

SA Murray (Class 3)

|

607,602

|

161,417

|

$4,578

|

$2,043

|

$739

|

|

TOTAL

|

7,704,439

|

1,624,585

|

$17,661

|

$5,065

|

|

Entitlement type

|

No. traded

|

Volume traded (ML)

|

Estimated turnover value (million)

|

Estimated turnover (%)

|

Average annual gross return (%)

|

|---|---|---|---|---|---|

|

Vic 1A Greater Goulburn HRWS

|

845

|

38,647

|

$140

|

5%

|

10%

|

|

Vic 1A Greater Goulburn LRWS

|

348

|

27,281

|

$14

|

7%

|

0%

|

|

Vic 6 Murray (Dart to Barmah) HRWS

|

272

|

22,847

|

$88

|

9%

|

11%

|

|

Vic 6 Murray (Dart to Barmah) LRWS

|

142

|

12,516

|

$7

|

10%

|

0%

|

|

Vic 7 Murray (Barmah to SA) HRWS

|

961

|

39,416

|

$179

|

5%

|

10%

|

|

Vic 7 Murray (Barmah to SA) LRWS

|

191

|

12,259

|

$8

|

7%

|

0%

|

|

NSW Murray HS

|

63

|

4,082

|

$23

|

2%

|

7%

|

|

NSW Murray GS

|

75

|

30,944

|

$61

|

2%

|

0%

|

|

NSW Murrumbidgee HS

|

25

|

7,994

|

$46

|

2%

|

7%

|

|

NSW Murrumbidgee GS

|

44

|

22,383

|

$48

|

1%

|

1%

|

|

SA Murray HS

|

165

|

18,710

|

$86

|

4%

|

9%

|

|

TOTAL

|

3,131

|

237,078

|

$699

|

4%

|

|

Entitlement type

|

2018-19 No.

|

2018-19 Volume (ML)

|

VWAP ($/ML) 2016-2017

|

VWAP ($/ML) 2017-2018

|

VWAP ($/ML) 2018-2019

|

Annual change in price (%)

|

Three-year change in price (%)

|

|---|---|---|---|---|---|---|---|

|

NSW Gwydir GS

|

1

|

2,916

|

$2,200

|

$2,000

|

$2,374

|

19%

|

8%

|

|

NSW Lachlan GS

|

22

|

4,298

|

$532

|

$671

|

$996

|

49%

|

87%

|

|

NSW Lachlan HS

|

2

|

67

|

$1,800

|

$1,998

|

$6,600

|

230%

|

266%

|

|

NSW Lower Namoi GS

|

4

|

2,923

|

$1,935

|

$2,077

|

$2,270

|

9%

|

17%

|

|

NSW Macquarie And Cudgegong GS

|

18

|

2,454

|

$1,157

|

$1,258

|

$1,658

|

32%

|

43%

|

|

NSW Peel GS

|

3

|

365

|

$1,046

|

$1,087

|

$1,341

|

23%

|

28%

|

|

Entitlement type

|

2018-19

|

2019-20

|

|---|---|---|

|

Vic 1A Greater Goulburn HRWS

|

32%

|

2%

|

|

Vic 1A Greater Goulburn LRWS

|

0%

|

0%

|

|

Vic Murray HRWS

|

41%

|

2%

|

|

Vic Murray LRWS

|

0%

|

0%

|

|

NSW Murray HS

|

97%

|

97%

|

|

NSW Murray GS

|

0%

|

0%

|

|

NSW Murrumbidgee HS

|

95%

|

95%

|

|

NSW Murrumbidgee GS

|

3%

|

0%

|

|

SA Murray HS

|

100%

|

31%

|

|

Entitlement type

|

Extreme Dry (99 per cent chance of exceeding)

|

Very dry (90 per cent chance of exceeding)

|

Median (50 per cent chance of exceeding)

|

|---|---|---|---|

|

Vic 1A Greater Goulburn HRWS

|

35%

|

48%

|

95%

|

|

Vic 1A Greater Goulburn LRWS

|

0%

|

0%

|

0%

|

|

Vic Murray HRWS

|

35%

|

52%

|

100%

|

|

Vic Murray LRWS

|

0%

|

0%

|

0%

|

|

NSW Murray HS

|

97%

|

97%

|

97%

|

|

NSW Murray GS

|

0%

|

0%

|

0%

|

|

NSW Murrumbidgee HS

|

95%

|

95%

|

95%

|

|

NSW Murrumbidgee GS

|

3%

|

3%

|

32%

|

|

SA Murray HS

|

100%

|

100%

|

100%

|

- Enterprises topping up smaller water portfolios to secure their long term needs.

- Water funds and investors continuing to see value in entitlements on the basis of lease products and forward contracts.

- Some large corporate agribusinesses that are making strategic purchases to manage risk and underpin long-term permanent developments.

- Ricardo 2019, Water supply and demand in the southern Murray–Darling Basin

- Ricardo 2018, Ricardo Water Markets Report 2017-18 review and 2018-19 outlook

- Ricardo 2017, Ricardo Water Markets Report 2016-17 review and 2017-18 outlook

- Ricardo 2016, Ricardo Water Markets Report 2015-16 review and 2016-17 outlook

- Australian Bureau of Statistics (ABS) 2018

- Bureau of Meteorology (BoM) 2019

- Commonwealth Environmental Water Holder (CEWH) 2019

- New South Wales Water Register 2019

- South Australia Water Register 2019

- Victorian Water Register 2019

- Water entitlements are ongoing rights to receive a share of available water resources in a consumptive pool. They are analogous to a land property right, are generally secure and mortgageable in the same way, and have substantial value. Each catchment typically has a small number of entitlement ‘classes’, and generally all entitlements within a given class are homogenous.

- Water allocations are the volumes of water allocated to water entitlement holders during the water year (1 July to 30 June). They are a physical good analogous to a commodity, and are extracted from water courses and applied as inputs to production or the environment. Their value per unit varies within and between years.

- Data cleaning method

- Rounding errors

- Irrigation corporation trade data

- Ricardo Entitlement Index

- Table notes

- Figure notes