How to maximise opportunities (and avoid risk) in the ever-changing ESG reporting landscape

09 Feb 2023

The rate of change and emergence of new ESG and climate legislation, frameworks, standards, and compliance criteria are daunting for all private sector companies. Understanding what is required in each market and jurisdiction is complex and time consuming. However, organisations that navigate this new landscape well, prepare early, and embrace the positive changes that the legislators are helping to drive are seeing far-reaching benefits.

In this blog, Ricardo’s Head of ESG, Jennifer Creek, takes a look at the key trends in the current and emerging ESG reporting landscape. Her expert lens will help you to prepare for the road ahead and avoid pitfalls.

Today the global ESG reporting landscape is predominantly voluntary, consisting of a growing number of voluntary reporting frameworks and standards, in addition to sector specific initiatives, certification bodies and ESG rating agencies. However, in recent years there have been a lot of changes with consolidation of standards and the shift to mandatory reporting, such as the TCFD requirements.

In the current landscape, both the EU and UK are rapidly moving ahead with climate change, ESG, and sustainability reporting requirements. The EU is leading on integrating broader ESG material topics into its mandatory reporting regime, whereas the UK is currently still more focused on integrating climate-related issues with the adoption of mandatory TCFD reporting within annual reports.

What’s the current state of play in the EU with regard to reporting regulations for companies?

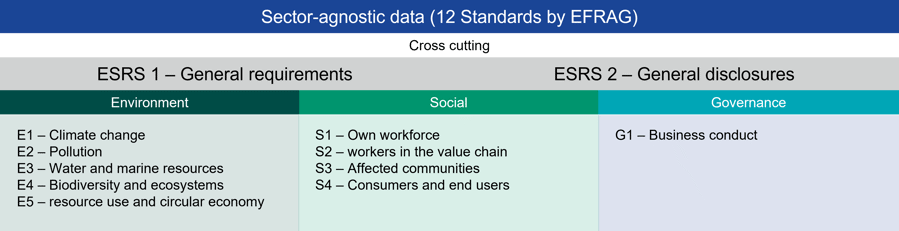

The EU has recently adopted the Corporate Sustainability Reporting Directive (CSRD) which will require businesses to report on a broad range of ESG matters, against a set of 12 mandated European Sustainability Reporting Standards (ESRS) that has been drafted by the European Financial Reporting Advisory Group (EFRAG). The CSRD will come into effect in phases starting from 2024.

The CSRD replaces the former Non-Financial Reporting Directive (NFRD), which was a softer law with flexibility on what to report and was applied only to large EU-listed companies. The CSRD expands the scope of companies included to non-EU listed, SMEs and third country companies – it’s estimated that around 55,000 companies, (compared to 11,000 under the NFRD) will be required to comply with the CSRD.

If two of the following three criteria apply, your company will be within scope:

- more than 250 employees

- more than 40 million euros in revenue

- more than 20 million euros in assets

It will also apply to SMEs whose securities are traded on a regulated market in the EU as well as subsidiaries of non-EU based companies.

The CSRD has arrived soon after the EU Sustainable Finance Disclosure Regulation (SFDR), which introduced a sustainability labelling regime for funds and asset managers, and the Taxonomy Regulation, which classifies sustainable economic activities and requires companies to disclose on eligibility and alignment with the green taxonomy.

How have EU reporting regulations progressed on due diligence, and how has the UK responded?

The EU Corporate Sustainability Due Diligence Directive (CSDDD) has been proposed and is under review, which will require in-scope EU and non-EU companies to assess and then address their adverse human rights and environmental impacts (and report on them under the CSRD). Whilst the UK did adopt the NFRD, due to Brexit, it won’t adopt the new CSRD, nor will it match the CSDD. The UK Government has stated that it is intending to bring in a UK equivalent in the form of the Sustainable Disclosure Requirements (SDR) regime and is focused on maintaining existing measures such as modern slavery reporting.

Requirements to report workforce data in the UK are spread across multiple authorities, including the obligation in the International Financial Reporting Standards (IFRS) to disclose basic figures on employee benefits such as pay, annual leave, bonuses and non-monetary benefits; and to produce a statement in the strategic report describing how the directors consider the interests of employees.

What are the UK’s plans?

Planned adoption of ISSB

The UK government has confirmed that it plans to adopt and endorse corporate reporting standards for sustainability in line with those being developed by the International Sustainability Standards Board (ISSB). The ISSB published an update, on its initial proposed climate and sustainability related disclosure standards released earlier last year– the Exposure Draft IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and Exposure Draft IFRS S2 Climate-related Disclosures. These standards will be important to consider for early adoption in anticipation for upcoming UK requirements and are planned to be finalised summer 2023.

Climate transition plans

In the UK, the government has already implemented mandatory climate reporting for listed and large private companies (>500 employees) under the Taskforce on Climate-related Financial Disclosures (TCFD) framework. Last year it published its consultation on Sustainability Disclosure Requirements (SDR) for the regulated finance sector, which will include sustainability labelling and a taxonomy (covering similar ground to the EU's SFDR).

Alongside TCFD and ESG disclosures, many businesses are adopting climate transition plans. The UK has announced that it will introduce mandatory publication of these plans for certain business, expected in 2023. In November last year, the UK Transition Plan Taskforce (TPT) published for consultation its proposed disclosure framework for private sector climate transition plans and accompanying implementation guidance. The accompanying draft guidance sets out steps for developing a transition plan in addition to how and where to disclose it.

Ricardo led a study for the UK Climate Change Committee (CCC) in preparation for the UK Government’s plans to require UK listed companies and financial institutions to publish “net zero transition plans” which were announced at COP 26. To inform its assessment and recommendations, the CCC commissioned Ricardo to provide an independent assessment of some of the key considerations and principles which those designing transition plan standards and the accompanying monitoring & enforcement framework should keep in mind. Read Ricardo’s assessment for the CCC.

Code of Conduct for 3rd party ESG data

Recently the UK Financial Conduct Authority (FCA) announced the formation of a new working group to develop a voluntary Code of Conduct for 3rd party ESG data and rating providers. A key aim of the working group will be to identify and establish in industry-led solutions relating to financial services firms' use of third-party ESG data and rating services.

Time to take action on ESG reporting

As corporate sustainability efforts are quickly moving from voluntary to mandatory, the scrutiny these efforts are put under also continues to grow. ESG performance is increasingly used to draw conclusions about the quality of an organisation’s management, identify their exposure to risks, and assess their ability to leverage business opportunities.

Your organisation must adopt a robust ESG reporting strategy that not only aligns to current regulations but prepares for future regulations which will only continue to increase in scope of reporting and number of organisations required to report. Mapping the current voluntary standards and frameworks will help you anticipate emerging regulations and better prepare to respond and remain competitive to your key stakeholder needs, including investors and customers.

This landscape is complex, but Ricardo’s experts can help you to fully understand these changes in legislation and regulations that could affect your business operations. We can advise you on the best approach to reporting to support your organisation’s vision and requirements.

We can also support your own reporting to investors, suppliers, customers, employees and other stakeholders by integrating ESG reporting into your annual report or creating a standalone sustainability or ESG report demonstrating your overall vision, goals and progress.

Further information

Find out how we can support your organisation with ESG reporting as well as setting and implementing a robust ESG strategy.

Get touch

Find out more about all our ESG capabilities

Follow Ricardo plc for regular updates

Follow Ricardo plc for regular updates