ESG in the chemical sector: navigating reporting practices and anticipating future regulatory disclosure requirements

In this blog, Ricardo’s Head of ESG, Jennifer Creek, discusses the key trends in current and emerging ESG reporting and what that looks like for the chemical industry. Jen has a long history working in the chemical sector and combines her knowledge of the sector with her ESG expertise to explain ESG requirements and how they apply to help you to strategically navigate this complex landscape.

The global ESG ecosystem – where to start?

The rate of change and emergence of new ESG, climate and sustainability reporting legislation, frameworks, standards, and compliance criteria can be daunting for chemical companies of all sizes. The global ESG reporting landscape ‘the ESG ecosystem’ has been predominantly voluntary, consisting of a growing number of voluntary reporting frameworks and standards over the years, in addition to sector specific initiatives, certification bodies and ESG rating agencies.

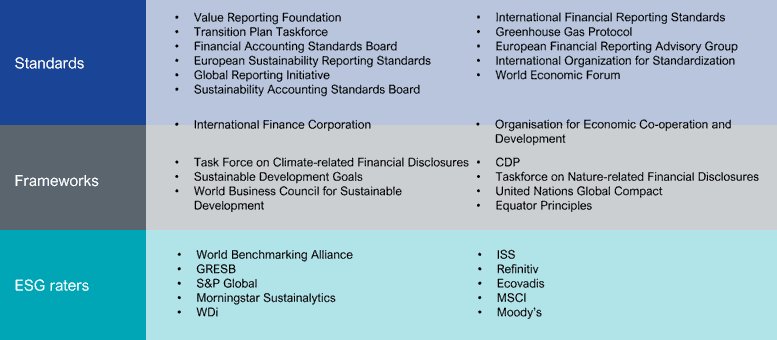

The ESG ecosystem can be grouped into three main types:

• organisations that publish standards,

• those that issue frameworks and guiding principles and

• ESG raters who independently assess the ESG performance of a company.

ESG Ecosystem of standards, frameworks and ESG raters

The Global Reporting Index (GRI) defines standards as “the agreed level of quality requirements, that people think is acceptable for reporting entities to meet”, whilst “frameworks provide the ‘frame’ to contextualise information” and are usually a starting point in the absence of a well-defined standard.

An example of a sector-specific chemical sector standard would be the Sustainability Accounting Standards Board (SASB), now consolidated under the International Financial Reporting Foundation (IFRS), and part of the International Sustainability Standards Board (ISSB). The SASB standards are unique in taking an industry-based approach to investor-focused sustainability reporting. SASB’s latest update to the chemical sector standards is to incorporate a new disclosure topic of the risks and opportunities associated with single-use plastics and bio-alternatives.

ESG raters use independent assessments to capture a ‘score’ of the ESG performance and maturity of a company or organisation and is usually comprised of a quantitative score and risk exposure. ESG raters and standards typically apply sector-specific criteria, whereas frameworks are sector-agnostic.

The chemical industry is a diverse sector and is typically grouped and peer benchmarked by ESG raters accordingly to their sub-sector categorisation; commodity, diversified, speciality chemical and fertilisers & agricultural chemicals. This allows for subtle differences in ESG material themes and weightings of scores, as can be seen by third party ESG rater MSCI in their MSCI’s ESG Industry Materiality Map, which it uses to identify sector-specific ESG issues that contribute to the companies’ ESG rating and weight and score appropriately. This can also be a challenge for some chemical companies that don’t fall neatly within one sub-sector group, especially since many ESG raters base their analysis on lagging, historical measures.

At the international level, the International Organisation of Securities Commissions (IOSCO) have recommended securities regulators should strengthen their oversight of ESG ratings and data providers after "several areas of concern" were identified by market participants. The UK and the European Commission have been recommended to align on a global coherent approach in line with IOSCO’s recommendations. This development comes as the ESG rating providers face greater oversight by global regulators in territories including the UK, EU, Japan, and India.

The UK Government recently announced that providers of ESG ratings will face being regulated in the near future, which could make the UK the first country to enforce this. A consultation was issued in March 2023 on the future regulatory regime for ESG ratings providers.

This follows the European Commission who also launched a targeted consultation on the functioning of ESG last year, covering both ESG factors in credit ratings and ESG ratings. In August 2022, the Commission published its summary report for the consultation, which reported that “all respondents replied that they value and need transparency in data sourcing, methodologies, and timeliness, accuracy, and reliability of ESG ratings”. The Commission is now planning its next steps, including potential legislation and non-legislative measures expected later this year.

ESG performance is increasingly used to draw conclusions about the quality of an organisation’s management, identify their exposure to risks, and assess their ability to leverage business opportunities. The importance of accurate and auditable disclosure of sustainability data is growing.

Anticipating future regulatory disclosure requirements

The chemical sector has been voluntarily reporting against ESG related metrics for a number of years, through its own sector specific Responsible Care ® programme, as well as standards and frameworks such as GRI, CDP, the chemical sector standards published by SASB and the Task Force on Climate-Related Financial Disclosures (TCFD).

However, in response to the gap between the demand for high quality, standardised ESG information by investors and available company information, several countries have initiated mandatory ESG disclosure regulations to enforce the disclosure of ESG information into traditional financial disclosures. In recent years significant changes globally have initiated the shift from voluntary to mandatory reporting requirements, with governments pushing for a global level playing field, expanding the scope to impact companies outside of the typical parent company jurisdiction. Examples of some of these changes include:

International Developments

In 2021 at COP26, the IFRS foundation formed the ISSB and consolidated the Climate Disclosure Standards Board (CSRD) and the Value Reporting Foundation (VRF). SASB, and Integrated reporting (IR) - who were formerly under the Value Reporting Foundation - also consolidated under the IFRS family. This has significantly raised the profile of IFRS and its importance for future reporting.

In 2022 ISSB launched two initial Sustainability Disclosure Standards IFRS S1 – General Requirements for Disclosure of Sustainability-related Financial Information (S1) and IFRS S2 – Climate-related Disclosures (S2), which set out the requirements for disclosures over climate and general sustainability reporting. A key requirement of the exposure drafts is for the sustainability reporting to be connected to and complement the financial statements. The standards are scheduled to be released in their final form in June 2023 and will be effective for annual reporting periods beginning on or after 1 January 2024; this means for reports prepared in 2025 for the fiscal 2024 reporting period.

A recent “relief package” for the first reporting period has been added, whereby companies will not be required to report sustainability information at the same time as financial statements, measure emissions according to the GHG Protocol Corporate Standard, nor to disclose scope 3 emissions.

UK Developments

In April this year, the UK government announced its ‘Mobilising Green Investment: 2023 green finance strategy’, whereby it plans to adopt and endorse the work of ISSB and will set up a framework to assess the standards and their suitability for adoption in the UK as soon as the standards are finalised (expected summer 2023) and are expected to be adopted under UK law by 2024 or 2025. This builds on the current UK climate-related mandatory reporting requirement in accordance with the Task Force on Climate-related Financial Disclosures Framework (TCFD) in the Company’s Strategic Report and the UK Stewardship Code that require businesses to disclose data relating to sustainability considerations. It’s important to note that the implementation of IFRS and IFRS 2 is not mandatory yet, so whilst the UK wants to take the lead to integrate into their regulatory regime, for other countries it will be up to each jurisdiction to follow its due process in reviewing the standards and deciding if and how to include them in their disclosure regulations.

EU Developments

The European Commission’s adoption of the Corporate Sustainability Reporting Directive (CSRD) in December 2022 will affect an estimated 10,000 non-EU companies operating in the EU (whether listed or not) if they meet the thresholds. The CSRD is complex and extends its legal sustainability reporting obligations for the first time outside of the EU borders sometimes also referred to as the “Brussels Effect”. The CSRD requires businesses to report on an extensive range of ESG matters against a set of 12 mandated sector agnostic European Sustainability Reporting Standards (ESRS) and publish in the company’s annual filings, accompanied by limited assurance. The CSRD will also catch non-EU companies that have at least one subsidiary or branch in the EU and a net turnover (revenue) of more than €150 million generated in the internal market. If the non-EU company has an EU subsidiary, the CSRD will only apply if the subsidiary is either large or listed and is not a micro undertaking. If the non-EU company has an EU branch, the CSRD will only apply where the branch generates a net turnover of more than €40 million.

The EU Parliament is also in the process of finalising its negotiation position on the proposal for a Corporate Sustainability Due Diligence Directive (CSDDD). Under the Commission's proposal for the CSDDD in-scope companies would be required to conduct human rights and environmental due diligence across the whole of their business (including any subsidiaries) and any value chains, and publicly disclose. It’s worth noting that in addition, the CSDDD states that all company directors would be obliged to implement a transition plan compatible with a global warming limit of 1.5°C. Directors of companies with over 1000 employees will be directly responsible for this step, which in turn will affect the variable parts of their pay, such as bonuses.

US Developments

The US SEC released its consultation in 2022 on proposed climate disclosure rule requirements for all “filers” (including “private foreign filers”) to report scope 1 and 2 emissions, and possibly scope 3 depending on materiality. The rules would require companies to discuss material climate-related risks and impacts on their business, strategy, and outlook, as well as their climate risk management and transition activities.

Chemical companies, similar to a broad range of corporate sectors, are under pressure from investors and consumers to improve ESG across their entire value chain. Chemical companies are particularly held accountable for sourcing raw materials responsibly as well as improving the recyclability of products produced by downstream industries. Due to the global nature of the chemical sector’s value chain, it’s essential to be aware of global changes in sustainability and ESG reporting practices as these can affect your business both directly and indirectly through customer and investor requests for data as well as your choices of suppliers when identifying risks within your value chain.

High-level ‘hot spot’ ESG Gap Analysis

It’s important to consider conducting a gap analysis to assess your current situation on sustainability reporting in anticipation for upcoming requirements. By starting early this will help you to quickly identify opportunities to improve your management and disclosure practices and ESG metrics so you can take the right action to drive performance and give your stakeholders confidence in your company’s readiness.

Due to the different company maturity levels and the complex nature of company financial reporting entities, a bespoke gap analysis is often the best approach. At Ricardo, our approach is to typically take the following initial steps as part of our client ESG journey support:

- High level ‘ESG ecosystem’ horizon scanning – understanding the emerging reporting issues

- Regulatory ‘hot spotting’ – bespoke sector focused checklists and analysis based on your geographic exposure – are you ready and what are the critical gaps?

- Standard mapping and ‘deep dives’ with our extensive knowledge pool of thematic ESG and chemical experts on hand for advisory discussions

To find out more about how Ricardo can support you to develop and implement an effective ESG strategy:

• Get in touch

• Visit our ESG services webpage

• Corporate Sustainability Reporting Directive (CSRD) Support