Ricardo Centre of Knowledge

Ricardo Centre of Knowledge enables clients to access industry knowledge and research in a fast and accessible way.

Stay up to date with our industry leading EMLEG and RiCK databases, Technical Updates and news products.

The industry is developing at a rapid pace, and it’s important to be able to navigate through information overload to identify reliable and trustworthy data to aid decision-making.

Ricardo Centre of Knowledge provides a group of services that exist to enable clients to access automotive, engineering, environment, energy and transport knowledge and research in a fast and accessible way.

RiCK™ Database

The information contained within RiCK™ is helpful to anyone embarking on automotive, engineering, transport or energy projects. RiCK™ also helps teams collaborate with a shared content feature that allows searches to be saved in a dedicated space. The database houses over 300,000 abstracted references, including industry-leading papers and articles. A team of dedicated information specialists assist with searches and ensuring the quality of content within the database.

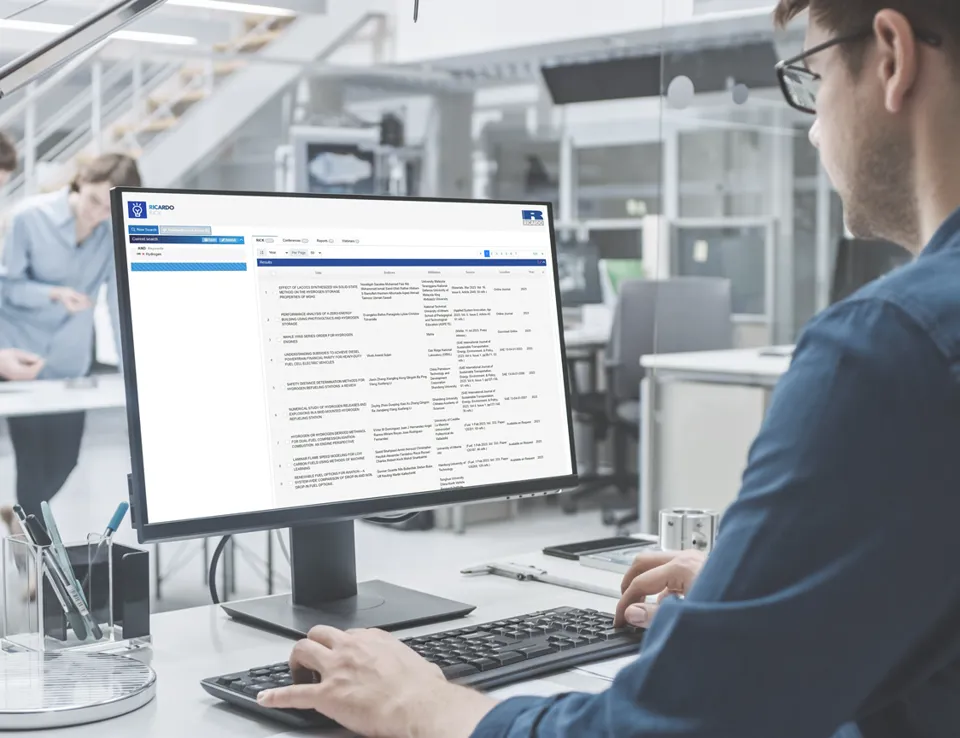

EMLEG

EMLEG is Ricardo's Emissions Legislation database. EMLEG allows users to keep up-to-date with the latest changes in global emissions legislation; EMLEG contains summaries and data from emissions legislation and CO2 emissions standards and it provides links to the official regulations. It covers draft and final standards. The database contains information on the EU, US India, China and several other markets worldwide and it provides data on emissions regulations by country and by market sector.

RiCK™ News

Streamline your news search with a subscription to RiCK™ News. Let artificial intelligence monitor the news for you and receive weekly alerts of high-quality breaking news from Reuters, Bloomberg and other leading media outlets. The content is aggregated from over 80,000 news sources and will provide an overview of the latest developments in a specific subject.

Technical Updates

A suite of curated technical updates compiling content from the RiCK™ database. These regular technical updates cover specific subjects and are delivered monthly. The topics include Autonomous Vehicles, Decarbonisation, Engines, Fuel Economy, Fuels & Lubricants, Hybrid & Electric Powertrains, Hydrogen, Rail and Transmissions. A subscription to these can be purchased by contacting us using the form below.

Conference List

The Ricardo Forthcoming Conference List provides details of planned Conferences and Exhibitions several years in advance. Sectors covered include passenger car, commercial vehicle, autonomous vehicles, fuels and lubricants, rail, defence, marine, motorcycles, engines, new energy and more.

Both the EMLEG and RiCK database are offered as annual subscription services (online databases). The Technical Updates and RiCK News offerings are also annual subscriptions (emailed directly to subscribers).

A subscription to EMLEG includes monthly update emails, sent directly to subscribers.

A subscription to the RiCK database includes onboarding emails and support searches for all users.

Our client list includes global original equipment manufacturers (OEMs), suppliers, and fuel and lubricant companies.

Our products

Learn more about our database and knowledge products provided to OEMs and suppliers by Ricardo experts.

RiCK™ Technical Information Database

RiCK contains over 340,000 abstracts and extracts handpicked by Ricardo’s Information Specialists. RiCK is updated continuously, with more than 700 entries added each month.

EMLEG

Ricardo’s comprehensive, global database contains simplified, up to date summaries of emissions legislation, technical information, and CO2 emissions standards to help individuals and businesses keep up to date with the latest regulatory changes.

RiCK™ News

Our weekly email update subscription for executives, engineers, sales and marketing teams. RiCK™ News draws on 80,000 trusted news and industry sources.

Technical updates

Keep your competitive advantage with Ricardo Technical Updates, featuring abstracts from various technical reports, research and policy papers, curated and checked by our experts.

Conference list

Stay up-to-date on all the upcoming transport, hydrogen and decarbonisation conferences with one subscription.

Markets

This service is offered within the following sectors.

Related news and downloads

South Australia Net Zero Rail Study

Read case studyCommon Safety Method for Risk Evaluation and Assessment

Read eventThe significance of persistence assessments for the chemical sector

Read insightRicardo Centre of Knowledge Resources